Review

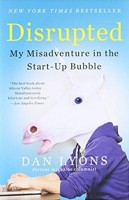

Title: Disrupted: My Misadventure in the Start-Up Bubble

Author: Dan Lyons

A real world story about a tech journalist who, at age 51, enters the Silicon Valley startup ecosystem by joining HubSpot, a company offering marketing and social media tools. It depicts a tale equally hilarious as worrying, of how a company could be burning tons of money and still aiming for an IPO, of how employees could have very aggressive goals to met (or get fired) but have "candy machines", and lots of scenarios that most normal people wouldn't believe to be real at a workplace.

While there are really funny moments, seems clear that the author had a very rought journey. He even had an abusive boss, and the fragments that tell it become grim and uglier, so it is far from being all bro-tales and crazy parties. But apart from the obvious fact that the book became a best-seller and that the author also helped in production of one of the early Silicon Valley seasons when he was at the end of his "adventure" (I wonder how many ideas came from the experience...), he got out of the company :)

I've also recognized some perks, attitudes and details that, in a normal scale, are actually applied not only to Silicon Valley startups but more in general around the world. Some of them, like the "fearless friday" (invest 20% of your time in different tasks/projects/ideas) are quite good when properly executed (in my opinion at least), but I can understand how the author just felt them stupid as taken alongside the rest looked absurd.

A great read to detect things not to adopt (or to flee from), written with a huge sense of humour considering the severity of the situation, and sometimes, similarities with a job you might have had.

Notes

This time the notes I've highlighted from the book are a mixture between jokes, terms and things learned, mottos and famous sentences, and crude but sometimes real statements about the startup world.

- Corporate cultures usually evolve organically, some startups try to create a culture artificially and impose it on the organization

- Dunning-Kruger effect: named after two researchers from Cornell University whose studies found that incompetent people fail to recognize their own lack of skill, grossly overestimate their abilities, and are unable to recognize talent in other people who actually are competent

- The lower end of the market is a dial-for-dollars segment

- Bubble Economics: companies do not have to generate a profit before they can go public, but they do have to demonstrate revenue growth

- The founders see VCs as a necessary evil, tricksters who will try to cheat founders or even steal their companies away from them. VCs see founders the way music labels see bands, or the way Hollywood studios see movies—they're the talent, the way you make money. You bet on a bunch of them and hope that one or two hit it big

- Whatever money a company spends on cool offices and the frat-house parties, it's peanuts compared to everything else. "And think what they're getting in return for that," he says. "They're getting all these young kids who work cheap and don't stick around long enough to vest, and even if they do vest, they don't have much equity to begin with

- [Regarding HubSpot] so much as it is a financial instrument, a vehicle by which money can be moved from one set of hands to another. [...] have assembled a low-cost workforce that can crank out hype and generate revenue

- Keep sales growing, and keep telling a good story [...] and stay in business long enough for their investors to cash out

- Engineering came first, and sales came later. That's how I thought things worked. [...] I thought, for example, that tech companies began with great inventions [...] HubSpot started out as a sales operation in search of a product

- It's all about the business model. The market pays you to have a company that scales quickly. It's all about getting big fast. Don't be profitable, just get big

- What investors want to see: a bunch of young people, having a blast, talking about changing the world. It sells

- "Your company is not your family" -LinkedIn's multibillionaire cofounder and chairman Reid Hoffman

- Amazon backloads the grants so that the lion's share of the stock units arrive in years 3 and 4. Employees who leave after one year might reportedly get only 5 percent of their grant

- Give them all the candy and beer they can stomach, and keep telling them what important, meaningful work they're doing

- When a company has a traditional vacation plan, it is required by law to set aside a cash reserve to cover the cost of all of the vacation days that it owes to its workers. When employees quit or get fired, the company must pay them for the vacation time they have accrued. But if a company has no vacation plan, it doesn't have to set aside the cash reserve. [...] Better yet, the company can fire people without having to pay them for any accrued vacation time

- "The 'share economy' is bunk; it's becoming a 'share the scraps' economy"

- Valley employers claimed they could not find skilled workers in the United States, when in reality they just didn't want to pay higher wages to Americans. Foreign workers are easy to intimidate [because of the working visa]

- The old guard companies, like Microsoft and Lotus Development, generated massive profits almost from the beginning, while today many tech companies lose enormous amounts of money

- Silicon Valley created a new kind of company, one that can lose money for years, and in fact might never turn a profit, yet still can make its founders and investors incredibly rich

- New business model: Grow fast, lose money, go public

- "If you can't dazzle them with brilliance, baffle them with bullshit"- W. C. Fields

- A form of financial alchemy, one where someone makes money by losing money

- [employees could win] the Golden Unicorn, a prize for being that week's outstanding marketer. This is an actual tiny statue of a unicorn, in gold

- A gaffe is when a politician tells the truth

- Some, like Uber and Airbnb, have built their businesses by defying regulations

- There's also a sense among start-ups that it's okay for them to break the rules because they're underdogs competing against huge opponents

- [Typical thinking] Why should [someone at the company from long] have a lower title than the new guy?

- "everything is awesome"

- "Misleading investors or overpromising. So what are you getting if you buy this stock? You're not really investing; you're speculating. You're hoping that whatever price you pay, someday someone else will be willing to pay more for it"

- "Go public or go broke"

- [Summary of HubSpot according to the book author] wacky frat house with Cinco de Mayo margarita bashes and sales bros puking in the men's room and a bunch of clueless twenty-something managers

- "teddy bears being given a place of honor at the table during management meetings"

- Hiring kids, cutting corners, breaking rules

- People who use online services are not the customers. We're the product